Six trends that will define the future of retail banking

Datos Insights explores how each trend will impact financial services and why AI will play a pivotal role.

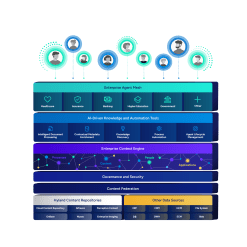

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Automate your document-centric processes with AI-powered document capture, separation, classification, extraction and enrichment.

Learn about Hyland IDPIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

Discover why Hyland is trusted by thousands of organizations worldwide.

Hear from our customers

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Join The Shift newsletter for the latest strategies and expert tips from industry leaders. Discover actionable steps to stay innovative.

Register now

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Reading time minutes

Datos Insights explores how each trend will impact financial services and why AI will play a pivotal role.

As the retail banking industry continues to evolve, there is an omnipresent theme. Artificial intelligence (AI), for better or worse, will have a significant impact on the industry.

AI, according to Datos Insights, “is arguably the most transformative technology since the adding machine.”

This whitepaper from Datos Insights and Hyland examines six banking trends that will define the future of financial services and looks at how AI touches each trend.

You’ll learn about the adoption of generative AI, cloud-first approaches, modernizing technology cores and much more. The report explores why each trend is important to financial institutions and how it will impact them.

How can banks prepare for future advancements? This whitepaper provides some answers.

> Learn more | A three-pronged approach to innovation for financial firms

AI is transforming the banking industry. Explore key impact areas, use cases, the power of content intelligence and indicators of AI-readiness.

Is your organization considering a technology upgrade? This legacy assessment provides answers.

Search for any resource available on Hyland.com.

Future-ready bank deploys Hyland OnBase in the cloud to automate business processes, securely manage documents and empower employees.