3 ways to tackle mortgage servicing pain points

Address challenges while improving relationships with borrowers, increasing productivity and creating growth opportunities.

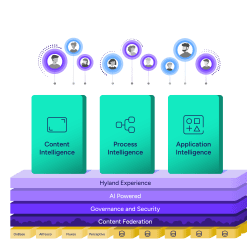

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Explore Hyland’s solutions by industry, department or the service you need.

Overview of solutionsIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

Discover why Hyland is trusted by thousands of organizations worldwide.

Hear from our customers

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Find resources to power your organization's digital transformation.

Browse the resource center

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Let’s take a look at three pain points that dominate the mortgage servicing industry that you can solve with technology.

Oftentimes, you receive large volumes of documents in a variety of formats and types to be manually sorted, which can be overwhelming. And, it doesn’t help when manual and sluggish processes lead to slower transaction times, which makes borrowers unhappy.

Your staff is often bogged down by tedious administrative tasks, resulting in data entry errors and duplications. In addition, having to bounce between various devices or logins while attending to borrowers’ queries can seriously affect job efficiency as well as your service reputation.

Labor-intensive verification processes often lead to high incidences of errors and incomplete loan packages due to missing or lost information during data transfer. And with more stringent regulations, this often results in financial penalties.

Thanks to innovative mortgage lending solutions, you can now address these, and other, industry pain points.

This means smoother processes, faster transaction times, better compliance and increased data accuracy. More importantly, with the right solution, you increase your ability to provide a positive borrower experience, reduce operational costs and increase growth opportunities.

With intelligent capture technology, you separate, classify and extract the right data directly from documents. You draw key information from paper – as well as scanned documentation – in a fast and accurate manner, as the solution validates all data before sharing it with other systems.

Coupling this with advanced document management capabilities empowers you with almost instant access to documents, so you offer borrowers quicker, more knowledgeable service.

A robust mortgage lending solution will also include automated workflow capabilities. Workflow helps you streamline tasks and timelines, create digital checklists and automate validation processes to verify information as it is being imported into the database. Thus, ensuring minimal incidences of errors or duplications.

From sending payment reminder notifications to tying borrowers’ accounts to loss mitigation and loan management records, you enhance your service efficiency. Automating these processes frees resources, saves time and allows staff to focus on critical tasks like ensuring positive customer experiences and producing innovative products to attract new borrowers.

Utilizing a solution that ensures compliance with today’s mortgage industry regulations is the icing on the cake. You no longer have to be plagued by worries whenever there is new information added to a loan account.

The right solution completes and validates individual loan packages and larger loan bundles fast and efficiently, with features like electronic signatures, compliance checkers and automated validation processes.

Of course, the right solution will have the ability to extend beyond your immediate needs.

Aside from intelligent capture, document management and workflow automation, advanced solutions with capabilities like case management tools also empower employees to manage cases efficiently with better problem solving and decision-making abilities.