3 Technologies shaping future of AP Automation

It’s no longer a question of whether or not you should automate AP processes; it’s a question of how.

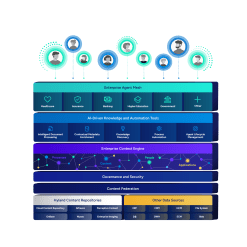

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Automate your document-centric processes with AI-powered document capture, separation, classification, extraction and enrichment.

Learn about Hyland IDPIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

Discover why Hyland is trusted by thousands of organizations worldwide.

Hear from our customers

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Find resources to power your organization's digital transformation.

Browse the resource center

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

In addressing today’s business challenges — and with an increasingly wide variety of accounts payable (AP) management software options available — it’s no longer a question of whether or not you should automate AP processes; it’s a question of how.

First, let’s take a look at the core components of AP automation. These features might vary across different solutions, but the building blocks of AP management software are as follows:

Invoice receipts

Invoice management and workflow automation

Electronic payments

Reporting and analytics

Supplier management

Increasingly, emerging technologies — including artificial intelligence, machine learning, blockchain, and big data — are strengthening these components, according to the 2020 Levvel Research Payables Insight Report.

Their application to AP is also becoming less abstract, with usage becoming so common that leading vendors have incorporated them in the core of their software, and basic providers at least have a plan for how they will use them in the future.

Here are the top three emerging technologies shaping the future of accounts payable and how they can help your organization turn AP into a profit center.

This Institute of Finance & Management (IOFM) whitepaper breaks down why automation is essential for global AP teams. It explores the benefits of modernizing, the risks of standing still, common pain points, what to look for in a solution and how one multinational organization transformed its end-to-end invoice processing.

Developers design artificial intelligence (AI) to mimic a human’s ability to think and utilize logic.

A subset of AI, machine learning (ML) improves on this process by “learning” patterns and habits, which allows the software to carry out and improve processes without explicit human instruction.

AI and ML are integral parts of AP automation and organizations use them in many different ways including detecting errors and discrepancies, intelligently matching items across purchase documents, and learning invoice and supplier habits to improve invoice capture and decrease human intervention.

In an advanced AP automation solution, for example, the invoice receipt component uses optical character recognition (OCR) paired with AI to intelligently fill in missing information into applicable invoice fields. It accomplishes this by using information from similar vendors and invoice formats to build an invoice pattern for an organization and invoice type.

This ensures invoicing becomes increasingly accurate and requires less human intervention as time goes on.

As AI evolves, enterprises are shifting their focus from generative AI hype to foundational innovations that drive scalable, impactful change. In this comprehensive report from Gartner, leaders get a roadmap for how to prioritize emerging AI technologies, so they can stay ahead with the right tools.

Explore key insights into the AI adoption journey, including the transition from experimental phases to scaling operations. Uncover how AI-ready data, AI governance and responsible AI implementations are becoming essential differentiators for businesses.

Big data refers to datasets that are too large and complex for humans to extract significant conclusions from. Big data analytics is the application of AI and ML algorithms to these datasets to analyze and detect trends.

With AP’s unique insight into an organization’s working capital, the use of big data gives organizations unprecedented visibility — not only into its past performance, but also to predict future outcomes. In other words, big data makes predictive reporting and analytics possible, which gives business leaders actionable insights into their organizations.

By integrating traditional statistical modelling with deep analysis of past information and trends, you can also make predictions to support future business decisions.

With advanced analytics tools, AP automation software offers internal benchmarking capabilities, drag-and-drop report building, and drill-down capabilities, allowing your organization to view a single set of data from multiple perspectives.

These reports are invaluable in providing a holistic overview of your organization’s cash flow, helping AP leaders to identify spending trends, optimize spend policies, and improve efficiency.

In the context of AP, blockchain’s best application is to enable e-payments. Using decentralized, distributed ledger technology that lets users control and update information, blockchain is an effective way to securely and accurately keep track of information.

The “block” aspect refers to the singular action and the related information, while the “chain” is the public record system that links the actions together.

Blockchain is appealing because you cannot alter or modify the blockchain after the event takes place, making it a secure, reliable source of truth.

While blockchain is still in the early adoption phase, many organizations are using it to increase the security of data and money transfers, facilitate connections among groups and individuals, and decrease latency in transfers between parties.

While the true impact of these emerging technologies will only be felt in the years ahead, organizations that do prioritize technology usage say it helps create a competitive edge, with AP automation credited as having a direct and positive impact to their financial health.

With AP automation, organizations surveyed in the Levvel report said they were able to accelerate approval cycles, increase employee productivity, reduce late-payment penalties, and lower overall invoice processing costs.

Automating AP processes also provides residual and strategic benefits such as improving supplier relationships, simplifying audits, and reducing fraud and duplicate payments.