RBC Capital Markets

Leading investment bank modernizes operations with Hyland's Alfresco platform.

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Automate your document-centric processes with AI-powered document capture, separation, classification, extraction and enrichment.

Learn about Hyland IDPIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

You’re shaping the future, now it’s time to celebrate your achievements at CommunityLIVE 2026.

Nominate by March 27!

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Join The Shift newsletter for the latest strategies and expert tips from industry leaders. Discover actionable steps to stay innovative.

Register now

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Reading time minutes

Leading investment bank modernizes operations with Hyland's Alfresco platform.

RBC Capital Markets is a global investment bank that provides services in corporate and investment banking, equity and debt origination, and electronic trading. The investment bank is part of the Royal Bank of Canada (RBC), the tenth largest bank worldwide and the fifth largest in North America.

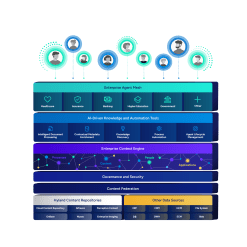

RBC Capital Markets adopted Hyland's Alfresco platform to modernize the systems that support post-trade activities, including confirmations, payments, tax provisioning, and meeting regulatory obligations.

Three years later, the organization has built and deployed 14 new applications supporting 3,500 business users, according to Jim Williams, Managing Director, Head of Operations and Shared Services Technology. The diverse solutions have helped the investment bank increase operational efficiency, tighten internal controls, and strengthen regulatory compliance.

One of the first use cases for the Alfresco Digital Business Platform was to facilitate the process-intensive workflows required to comply with tax-related regulations following a trade.

Alfresco platform fit the bill as a next-generation platform that combines process automation with rich document management capabilities. “The business needs to understand the details behind a document, not just the fact that we have the document,” Williams explains. “That’s where the Alfresco platform came into the forefront.”

— Ruchi Saraswat, Director, Global Head of Tax Operations

RBC Capital Markets has since addressed a variety of business needs with applications that integrate Alfresco Content Services and Alfresco Process Services (powered by Activiti). The investment bank has developed solutions to confirm equity trades, maintain job mandates, control market data requests, allocate payments for research services, and manage and track responses to regulatory audits.

The breadth of these use cases underscores the versatility of the Alfresco platform, which RBC Capital Markets is taking full advantage of. “A lot of the platforms we are moving away from are very difficult to maintain and keep evolving,” Williams declares. “What we’ve enjoyed, and have really been able to expand on, is the flexibility of the Alfresco platform and how we can make it work with our various requirements.”

Another benefit of the Alfresco platform at RBC Capital Markets has been the ability to keep pace with the needs of a rapidly growing business. “We can meet the business requirements and have a faster turnaround,” says Ruchi Saraswat, Director, Global Head of Tax Operations. She also credits Hyland's Customer Success team with helping RBC Capital Markets get up to speed quickly. “We can easily take on new challenges because we know we’ve got Alfresco backing us up.”

RBC Capital Markets leverages the Alfresco Application Development Framework (ADF) to accelerate solution onboarding. ADF allows IT to develop applications rapidly and iteratively using reusable pre or custom-built components. “It’s like LEGO® pieces, where we build all the modules and put them together,” Saraswat explains. “Reusable components really help the team a lot.”

The open, cloud-native Alfresco platform is also well-suited to modern DevOps practices. RBC Capital Markets has established a CI/CD process for Alfresco platform-based applications that uses popular tools like Docker, Kubernetes, Helm, Maven, Jenkins, and Git.

RBC Capital Markets runs bespoke solutions within the Tax and Confirmation space. By consolidating applications on the Alfresco platform, Williams’s team is driving an internal alignment that benefits developers and business partners alike. “We have a common platform with a common workflow and a common look and feel,” says Williams. “It’s very, very important.”

Saraswat agrees. She says the user-friendly solutions have been well received by the business and that consistency—the same screens, the same experiences — “gives users operational efficiency.” Alfresco platform’s seamless integration with email, reporting, and core banking systems further streamlines workflows.

Positive outcomes with the Alfresco platform have generated significant interest and several applications outside Tax and Confirmation. After integrating Alfresco Content Services with a Know Your Client (KYC) solution for new accounts, Saraswat says “a lot of teams reached out to us to understand how the document repository works.” A new requirement on the equity trading floor resulted in an application to manage risk limits, and Human Resources is expanding their use of the Alfresco platform to manage employee onboarding.

“As we showcase the flexibility and usability of Alfresco, we are getting demand everywhere,” says Williams, who believes there are a multitude of ways to leverage the platform across RBC.

Now that RBC Capital Markets has standardized on the Alfresco Digital Business Platform, the investment bank can quickly spin up applications to overcome a wide range of business challenges. The solutions are more stable, scalable, and supportable than those built on legacy platforms.

In 2018, RBC Capital Markets expanded its Alfresco license capacity to accommodate future growth. Looking ahead, Williams sees a significant pipeline of projects that includes migrating more applications from Pega to Alfresco platform. “I am a big fan of success breeding success,” Williams concludes.