Creditplus Bank AG

Bank automates and streamlines manual workflows by digitizing the loan payment process.

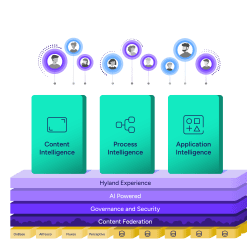

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Explore Hyland’s solutions by industry, department or the service you need.

Overview of solutionsIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

Discover why Hyland is trusted by thousands of organizations worldwide.

Hear from our customers

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Find resources to power your organization's digital transformation.

Browse the resource center

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Reading time minutes

Bank automates and streamlines manual workflows by digitizing the loan payment process.

Banks are under considerable pressure to digitize their services and processes to make them more customer-friendly. They need to strike a balance between innovation and efficiency and adopt a holistic approach to the digitization of processes to ensure they remain competitive.

Creditplus Bank AG has successfully modernized their approach to loan processing, thanks to a digital solution: a digital loan payment process application that helps the bank process loan applications faster and reduce costs. In doing so, the bank has shown a flair for innovation — as well as making things more customer-friendly and improving costs.

The digital loan payment process comprises various workflows that had previously been manual and paper-based. Depending on the risk assessment for a loan agreement, certain documents are required before it can be issued, such as proof of income, some form of personal identity, etc. The filing, checking and assessment of these documents are now mapped in digital processes.

The integration of other business applications from various departments within the bank has made it possible to map workflows end-to-end across several systems.

— Torsten Bauer, Director of Operations, Creditplus Bank AG

Thanks to a digital inbox, the staff at Creditplus Bank AG are assigned their tasks and documents automatically. Intelligent selection criteria ensures the appropriate person responsible for the task and the right documents are chosen. This allows employees to concentrate on the technical aspects of their work and relieves them of certain manual activities.

Digitalization eliminates many paper-based processes and the associated drawbacks, such as documents only being available to the employee reviewing them at that time and people having to wait for documents to begin their step in the process. Electronic documents can now be stored at a central location, given meta tags and browsed by anyone using a full-text search capability. Documents associated with applications are now easier to find.

As well as helping reduce processing times, the digitized loan processing has reduced the costs per loan application processed. And the transparency of the process has improved, which makes it easier to manage the workload involved. Another benefit is how users can see the current status of applications in the system at any given time. This has greatly improved the customer experience.

The bank selected it-novum, an Alfresco Strategic Partner, to help digitize its loan payment process. With the solution built on Alfresco Process Services, an enterprise business process management solution, the application was designed and implemented, including back-end integration with other business applications.

The loan application processes were mapped with Alfresco’s Process Services and a front-end, user interface built with Alfresco’s Application Development Framework (ADF) — modern JavaScript-based framework to rapidly build engaging web applications. The ADF was used to implement the end-user requirements very quickly with the agile methodology, thanks to the option of reusable Angular-based UI components and services.

As a result, Creditplus Bank AG was able to accelerate the introduction of the digital loan application process to improve the customer and employee experience, and increase their competitive advantage.