Civista Bank

Growing bank digitizes processes and enables continuous improvements to customer service.

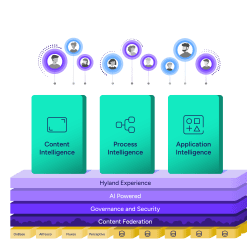

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Explore Hyland’s solutions by industry, department or the service you need.

Overview of solutionsIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

Discover why Hyland is trusted by thousands of organizations worldwide.

Hear from our customers

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Find resources to power your organization's digital transformation.

Browse the resource center

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Reading time minutes

Growing bank digitizes processes and enables continuous improvements to customer service.

Established in 1884, Civista Bank has a long history of providing financial solutions to businesses, families and consumers in Ohio. One constant throughout the bank’s history is its strong leadership team that remains committed to providing the focused and personal customer service that is a hallmark of community banks.

Civista was experiencing rapid organizational growth and nearing $1 billion in assets. But inefficient methods for document imaging, retrieval and workflow kept employees busy searching for paper documents, playing phone tag with customers and tracking process steps in spreadsheets. Bank leadership soon realized that paper-based processes wouldn’t support Civista’s continued growth and its mission to provide excellent service.

Civista Bank’s commercial lending business was a main driver in the effort to streamline processes. Prior to OnBase, Hyland’s enterprise information platform, Civista used a room in its vault to store massive amounts of paper documentation that flowed into the bank.

Commercial lenders submitted requests to the back office to have specific paper documents retrieved. Customers waited for their phone calls to be returned and often played phone tag with loan officers.

Pushma Vasilevski, associate vice president and project manager with Civista, led the evaluation of current-state processes and vendors. Finding a solution that extended beyond imaging to automate the entire commercial lending process flow from beginning to end was a priority for her team.

“OnBase was a favorite right away,” Vasilevski said. “I had previous experience with it, and I knew its flexibility would allow the software to be built out to fit Civista’s needs.”

But Civista’s commercial lending business was just the starting point. Soon after deciding on OnBase, Vasilevski and her team realized the solution’s potential went beyond commercial lending to include all of the bank’s lines of business.

— Rich Dutton, Executive Vice President and Chief Operating Officer, Civista Bank

Hyland experts assisted Civista’s project leaders in developing an implementation plan that would quickly deliver one of the bank’s most needed improvements. Civista’s consumer lending, commercial lending, retail banking and private banking businesses gained fast access to information and documentation in the first phase of the project.

Now, bank employees can pull up documents while they’re on the phone with clients.

“It’s a much more fluid transaction,” said Paul Koch, the bank’s associate vice president of commercial lending. “I don’t have to end my call with a customer and call back. Having access to the documents in OnBase saves a lot of time.”

Credit Analyst Nick Lublow said the benefits of OnBase reach far beyond information retrieval. Utilizing OnBase’s electronic workflow and WorkView, Lublow gains important visibility into his project pipeline.

“OnBase is pretty much where I live day-to-day. It’s a one-stop shop where I can see what I need to work on that day and access my actual working documents.”

Automated workflow also allows employees to create deadlines and goals. It also provides a clear view of where bottlenecks are occurring, which allows management to find timely solutions to problems and keep processes moving forward.

OnBase also integrates with Civista’s core Jack Henry system. According to Deb Kline, senior vice president of strategic initiatives, their retail banking employees give the solution rave reviews. They now have immediate access to driver licenses, signature cards and other critical information when they click on customer identification numbers, loan numbers or account numbers.

Provides immediate access to documents and information wherever and whenever needed: Employees gain access to digitized content directly from their laptops, desktop computers and tablets.

Aids in improved customer service: Customers receive faster responses to their inquiries and can get the services they need — such as wires, funds transfers and loan status updates — quickly and easily.

Reduces risks and improves compliance: With more accurate and secure methods for extracting, accessing and storing information, the potential for errors is reduced, and both bank employees and external auditors can get secure online access to the information needed for compliance.

Spans the entire enterprise: With an original focus on commercial lending, Civista quickly discovered OnBase could give employees in all its lines of business fast access to information in one central repository.