Cecabank

Cecabank transforms its legacy, paper-based systems with Alfresco platform to be a modern, future-ready financial institution.

Harness the power of a unified content, process and application intelligence platform to unlock the value of enterprise content.

Learn more

Automate your document-centric processes with AI-powered document capture, separation, classification, extraction and enrichment.

Learn about Hyland IDPIt's your unique digital evolution … but you don't have to face it alone. We understand the landscape of your industry and the unique needs of the people you serve.

Overview of industries

Overview of industries

Countless teams and departments have transformed the way they work in accounting, HR, legal and more with Hyland solutions.

Overview of departments

Overview of departments

We are committed to helping you maximize your technology investment so you can best serve your customers.

Overview of services

Overview of services

Discover why Hyland is trusted by thousands of organizations worldwide.

Hear from our customers

Our exclusive partner programs combine our strengths with yours to create better experiences through content services.

Overview of partners

Join The Shift newsletter for the latest strategies and expert tips from industry leaders. Discover actionable steps to stay innovative.

Register now

Hyland connects your content and systems so you can forge stronger connections with the people who matter most.

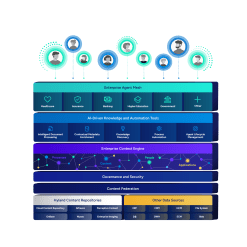

Learn about HylandWith our modern, open and cloud-native platforms, you can build strong connections and keep evolving.

Dig deeper

Dig deeper

Reading time minutes

Cecabank transforms its legacy, paper-based systems with Alfresco platform to be a modern, future-ready financial institution.

Cecabank is the heir to the Confederation of Savings Banks, founded in 1928. Originally, these savings banks had a social as well as a financial function.

During the financial crisis of 2008, the restructuring of the Spanish banking sector reduced the number of institutions from 45 to only 6 financial institutions and 2 savings banks in 2021. This change highlighted the need to adapt and modernize. Since then, Cecabank has established itself as a bank offering wholesale services to various financial institutions.

Cecabank's systems were legacy, outdated and difficult to maintain. These systems were heterogeneous and highly atomized, making them difficult to use and inefficient. With a clientele consisting mainly of financial institutions, there was a need for a more modern, efficient and secure system.

To carry out this transformation, Cecabank chose Hyland's Alfresco platform because of its process management capabilities. The implementation began in 2020 with a pilot of a financial transaction approval process, which had previously been paper-based. This initial process was designed and migrated to Alfresco's digital platform, which proved to be a very wise decision.

It started with simple processes and implemented them in stages. This resulted in Rocket, Cecabank's process portal. Throughout the process, Alfresco adapted to all their specific needs, making the platform easy to use and solving the previous problem of labyrinthine applications.

Reusable nodes and custom configurations were implemented, as well as mechanisms to measure and analyze processes in real time. In addition, Rocket was connected to a platform of data analysis tools such as Power BI for more effective use of information. The team's efforts to train employees and minimize resistance to change are noteworthy.

Employees can access documents and processes from a single point, making their work easier and improving operational efficiency.

Features include node customization, management and permissions, and integration with external data models. For example, one node, the visibility configuration node, allows us to easily manage the permissions that users have over their data processes and documents.

Managing processes such as Christmas basket requests, formalizing supplier contracts, mortgage loan issues and audits have become easy to manage thanks to Rocket. The quality survey conducted in 2023 revealed an exceptional approval rate, reflecting the satisfaction of users with the new platform.

Cecabank has several key objectives for 2024:

By taking these steps, Cecabank is not only modernizing technologically, but also building a solid foundation for future innovation and improvement in its financial services.